Streamline Your Finances: How to Develop an Efficient Accounting and Billing Web App

Are you tired of spending countless hours manually managing your finances? Say goodbye to the days of sifting through stacks of paper receipts and struggling to keep track of your accounts. With the ever-advancing technology, you can now streamline your finances and take control of your accounting and billing processes with the help of a web app.

In this digital age, efficiency is key, and developing an efficient accounting and billing web app can revolutionize the way you manage your finances. From automating invoicing and expense tracking to providing real-time financial insights, a well-designed web app can simplify your financial tasks and give you more time to focus on what really matters – growing your business. In this article, we will explore the essential steps to develop an efficient accounting and billing web app that will not only save you time and effort but also enhance the overall financial health of your business. Get ready to embark on a journey towards financial efficiency and success.

Why businesses need efficient accounting and billing systems

Efficient accounting and billing systems are crucial for businesses of all sizes. Whether you’re a small startup or a large corporation, managing your finances effectively is essential for sustainable growth. Without a streamlined accounting and billing system, businesses can face a multitude of challenges that hinder their financial health.

One of the main reasons businesses need efficient accounting and billing systems is to ensure accurate and timely financial reporting. With manual processes, there is a higher risk of errors and delays, leading to inaccurate financial statements and poor decision-making. By implementing a web app that automates these processes, businesses can eliminate human error and have real-time access to their financial data.

Another key benefit of efficient accounting and billing systems is improved cash flow management. Late payments and missed invoices can disrupt a business’s cash flow, causing unnecessary stress and potentially hindering growth opportunities. A web app that automates invoicing and payment reminders can help businesses stay on top of their accounts receivable and ensure timely payments.

Furthermore, efficient accounting and billing systems provide businesses with valuable insights into their financial performance. By analyzing data such as revenue trends, expense patterns, and profitability metrics, businesses can make informed decisions and identify areas for improvement. This data-driven approach allows businesses to optimize their operations and drive financial success.

Common challenges in managing finances and billing processes

Managing finances and billing processes can be a daunting task, especially without the right tools and systems in place. Many businesses face common challenges that can hinder their financial efficiency and impact their bottom line.

One of the most prevalent challenges is the manual entry of data. With traditional accounting methods, businesses often have to manually enter data from receipts, invoices, and other financial documents into their systems. This process is time-consuming and prone to errors, leading to discrepancies in financial records.

Another challenge is the lack of visibility into financial transactions. Without a centralized system, businesses struggle to track and monitor their financial activities effectively. This can result in missed payments, duplicate invoicing, and other costly mistakes that negatively impact the overall financial health of the business.

Additionally, managing multiple payment methods and currencies can be a challenge for businesses operating on a global scale. Converting currencies and reconciling international payments manually can be complex and time-consuming. An efficient accounting and billing web app can automate these processes, simplifying financial management across borders.

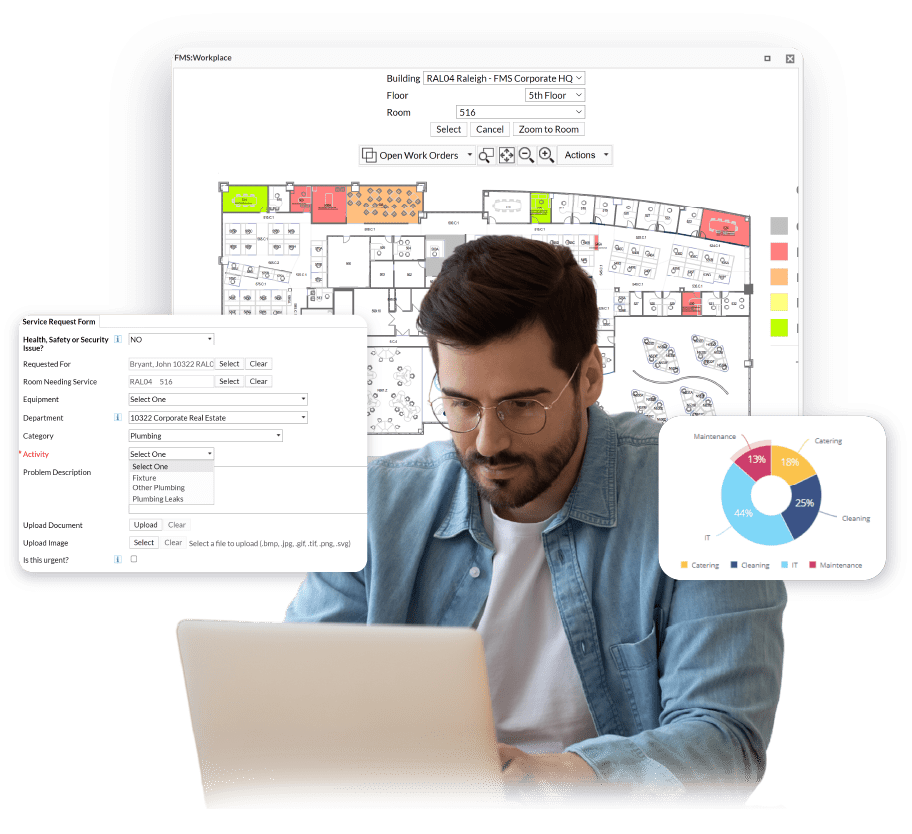

Key features of an efficient accounting and billing web app

To develop an efficient accounting and billing web app, it is essential to understand the key features that make such a system effective. These features should address the common challenges businesses face in managing their finances and streamline the entire process.

1. **Automated Invoicing**: The web app should have the capability to generate and send invoices automatically based on predefined templates. This eliminates the need for manual entry and ensures timely delivery of invoices to clients.

2. **Expense Tracking**: An efficient accounting and billing web app should allow businesses to track and categorize expenses effortlessly. This feature enables businesses to monitor their spending, identify cost-saving opportunities, and generate accurate financial reports.

3. **Real-time Financial Insights**: The web app should provide real-time access to financial data, including revenue, expenses, and cash flow. This allows businesses to make informed decisions promptly and keep track of their financial performance.

4. **Payment Processing**: A key feature of an efficient accounting and billing web app is the integration with payment gateways to facilitate seamless payment processing. This enables businesses to receive payments securely and efficiently, reducing the risk of late or missed payments.

5. **Multi-currency Support**: For businesses operating globally, the web app should support multiple currencies and handle currency conversion automatically. This simplifies international transactions and eliminates the need for manual calculations.

Benefits of using an efficient accounting and billing web app

Implementing an efficient accounting and billing web app offers numerous benefits for businesses of all sizes. Let’s explore some of the key advantages:

1. **Time and Cost Savings**: By automating manual processes, businesses save valuable time and resources. The web app streamlines accounting and billing tasks, allowing employees to focus on more strategic and revenue-generating activities.

2. **Improved Accuracy**: Manual data entry is prone to errors, which can lead to financial discrepancies and misreporting. An efficient accounting and billing web app eliminates human error and ensures accurate financial data.

3. **Enhanced Cash Flow Management**: With automated invoicing and payment reminders, businesses can improve their cash flow management. Timely invoicing and prompt payment processing reduce the risk of late or missed payments.

4. **Real-time Financial Insights**: An efficient web app provides real-time access to financial data, enabling businesses to make informed decisions promptly. By monitoring revenue, expenses, and cash flow in real-time, businesses can identify trends and take proactive measures.

5. **Simplified Compliance**: Accounting and billing compliance can be complex and time-consuming. An efficient web app automates compliance processes, such as tax calculations and reporting, ensuring businesses stay compliant with relevant regulations.

6. **Scalability and Flexibility**: As your business grows, your accounting and billing needs evolve. An efficient web app can scale with your business and adapt to changing requirements, ensuring long-term sustainability.

7. **Improved Customer Experience**: Streamlined billing processes and accurate invoicing contribute to a positive customer experience. By providing timely and accurate invoices, businesses can build trust and enhance customer satisfaction.

8. **Data-driven Decision Making**: An efficient web app provides valuable data insights that can drive decision-making. By analyzing financial data, businesses can identify opportunities for growth, optimize operations, and improve profitability.

In conclusion, developing an efficient accounting and billing web app can revolutionize the way businesses manage their finances. By automating invoicing, expense tracking, and providing real-time financial insights, businesses can streamline their financial processes, enhance cash flow management, and drive growth. When developing a web app, consider the key features, choose the right software, and follow the necessary steps for successful development. Ensure thorough testing and quality assurance, integrate with other systems, and prioritize security.

The benefits of using an efficient accounting and billing web app are numerous, from time and cost savings to improved accuracy and customer satisfaction. Embrace the power of technology and embark on a journey towards financial efficiency and success.